Ensuring full disclosure of income and expenses to the IRS and other relevant agencies for tax purposes is of utmost importance. By diligently providing all income and expense-related information, businesses and individuals fulfill their duty responsibly, alleviating concerns about potential legal penalties and audits.

To ensure compliance with tax regulations and fulfill their financial obligations, individuals and businesses have several methods available to provide necessary information to the IRS and other relevant agencies. These methods encompass a range of tax-related forms designed to accurately report income and expenses. Among these essential forms, one that holds particular significance is the 1099-MISC, which will be the focal point of our discussion in this blog.

What is Form 1099-MISC?

The 1099 series encompasses multiple forms, each serving distinct purposes. Notable examples include the 1099-S, utilized for real estate transaction proceeds, the 1099-OID, which covers original issue discount, and the 1099-G, dedicated to certain government payments. Among these forms, Form 1099-MISC holds its place as a significant member.

Taxpayers promptly receive 1099 series forms, including Form 1099-MISC, shortly after the financial year’s conclusion. These forms bear vital information that taxpayers require to fulfill their reporting obligations accurately.

Form 1099-MISC is a tax form used by both businesses and individual tax filers to report the payment and receipt of qualifying expenses during a year. It serves as a means for businesses or individuals (the payer) to inform the Internal Revenue Service (IRS) about the non-recurring expenses they have made and to whom they have made these payments. The payer also sends a copy of this filled form to the recipient, who uses it as proof of their miscellaneous income. In essence, we can say that it is a tool to report Miscellaneous Income to the IRS.

This form is specifically used to report various types of income, such as those arising from lottery winnings, royalties, dividends, rental income, attorneys’ fees, health care payments, fishing boat proceeds, payments to non-employees, crop insurance proceeds, etc.

Previously, the 1099-MISC form was known for providing details about miscellaneous income. However, there has been a recent change, and its purpose has been modified to encompass miscellaneous information pertaining to payments and income.

When someone (the payer) pays money to another person or business, they need to provide their own name, address, and taxpayer identification number in the 1099-MISC form. Additionally, they also need to provide the name, address, and Social Security number of the person or business (the recipient) receiving the money. This information is important for tax purposes and helps the IRS and other authorities keep track of financial transactions and ensure everyone pays the right amount of taxes.

Ways to File Form 1099-MISC

So, the payer (person or business) is required to file the 1099-MISC, and they should do so by January 31 of the following year in which payments are made. The payer can file the 1099-MISC Form either electronically or by mail, depending on their preference.

If the payer opts for electronic filing, they are required to use the IRS’s FIRE (Free File Electronic Reporting) system. FIRE is a free service provided by the IRS, allowing businesses or individuals to electronically file their 1099 series forms. This user-friendly service streamlines the process of reporting income and expenses to the IRS, offering taxpayers a convenient and efficient way to submit their forms.

If the payer chooses to file the 1099-MISC form through the mail, they must attach the 1096 form, which serves as a transmittal form. The 1096 form is used to summarize and submit the information from the 1099-MISC forms to the IRS.

How is Form 1099-MISC Reported?

So, there are a few steps involved in filing the 1099-MISC form. As mentioned earlier, Form 1099-MISC is filled out by the payer (business or individual), and then the payer sends a copy of this filled form to the recipient (individual or legal entity receiving the payment) and other relevant agencies. The recipient can use it as proof to show their income when they file for income tax.

Here is how Form 1099-MISC is reported:

Payers Reporting (Businesses or Individuals)

It is the payer’s responsibility to prepare and file Form 1099-MISC with the IRS and provide a copy of Form 1099-MISC to the recipient and other relevant agencies. Payer reporting involves the following steps:

1. Information collection: The payer is responsible for collecting all the necessary information concerning the money they have given to each recipient, which requires reporting on Form 1099-MISC. This information includes the recipient’s name, address, taxpayer identification number, or social security number, along with the total amount they paid to the recipient during the financial year.

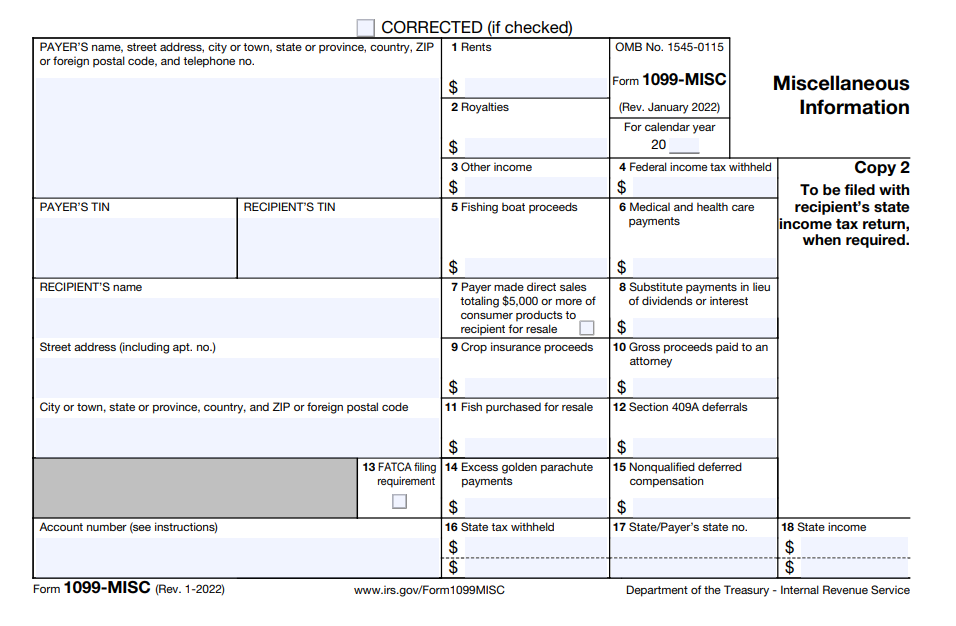

2. Form 1099-MISC filing: The next step is to fill out all the relevant information in Form 1099-MISC and complete it. The form has changed and now the revised version of the form has different box numbers for reporting various types of payments or receipts and other boxes to fill in information such as taxpayer identification number or social security number, boxes to fill address and name of the recipient. As aforementioned, they can file Form 1099-MISC electronically or by mail.

3. Provide copies of the form to relevant parties: The 1099-MISC form has various types of copies, including Copy A, Copy B, Copy C, Copy 1, and Copy 2. Each copy is designated for different parties, and it is the responsibility of the payer to send the relevant copy to the respective party. Here is how each copy should be sent or kept. The payer first sends Copy A to the IRS and then sends the other copies to relative parties.

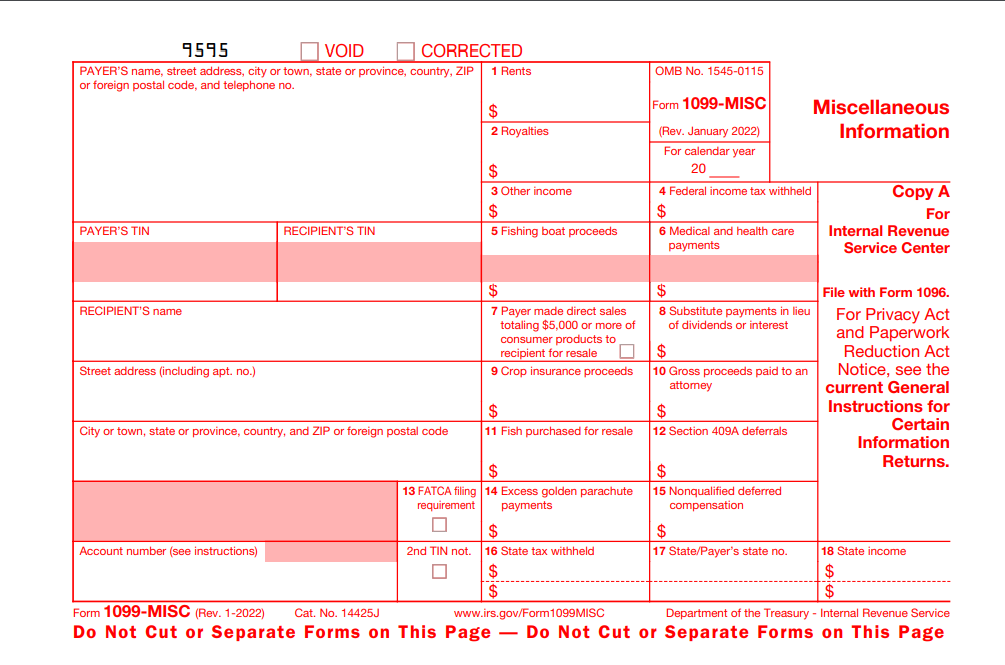

- Copy A: It is printed in red color, but it is not intended for printing by the filer (The Payer). Instead, this particular copy of the form is reserved for IRS use only.

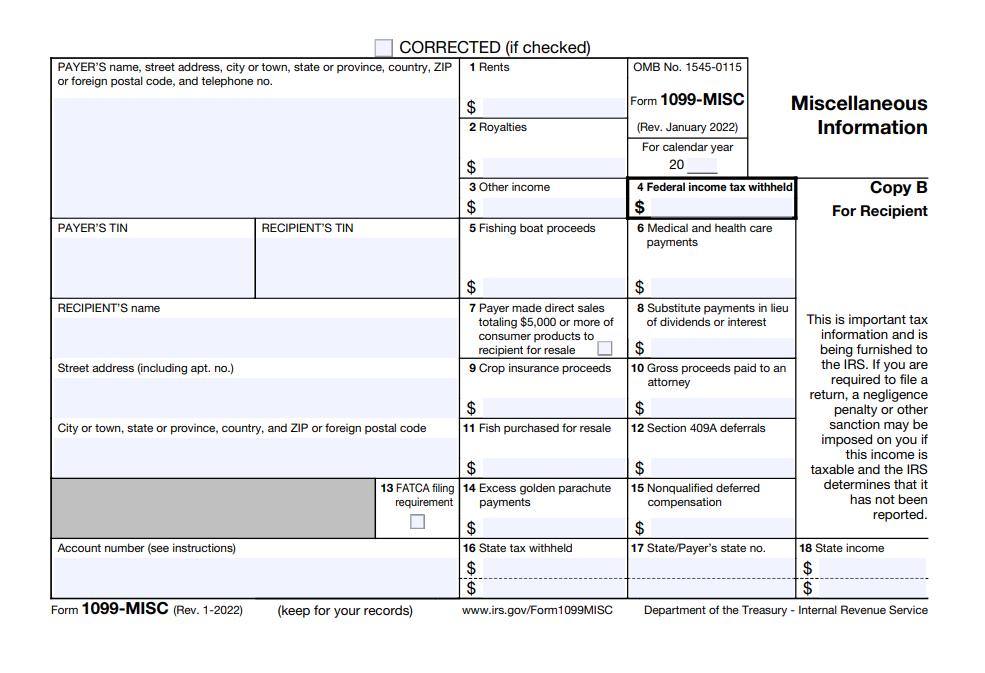

- Copy B: This copy is sent to the recipient.

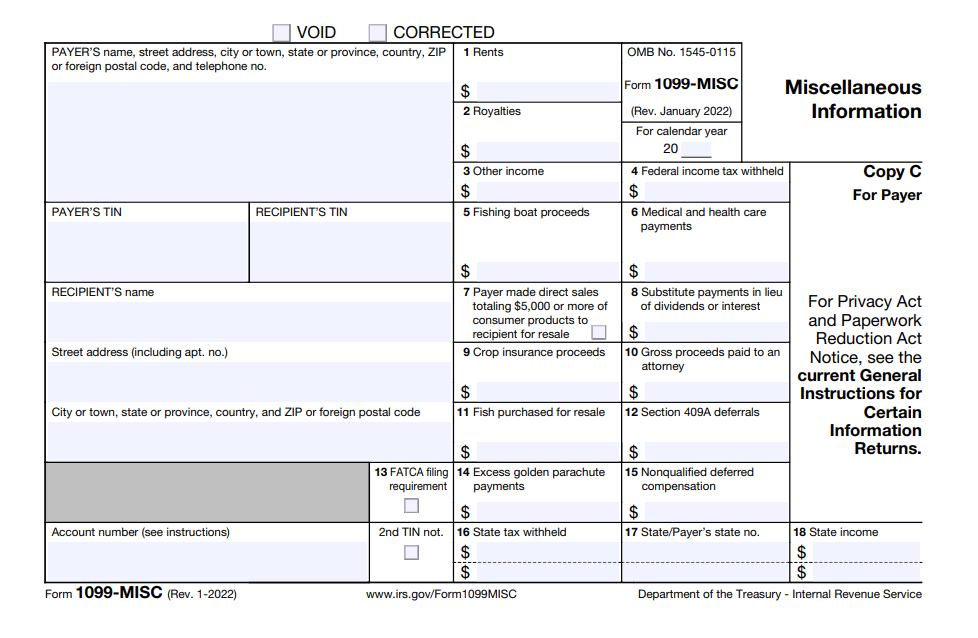

- Copy C: The payer retains this copy for record-keeping purposes.

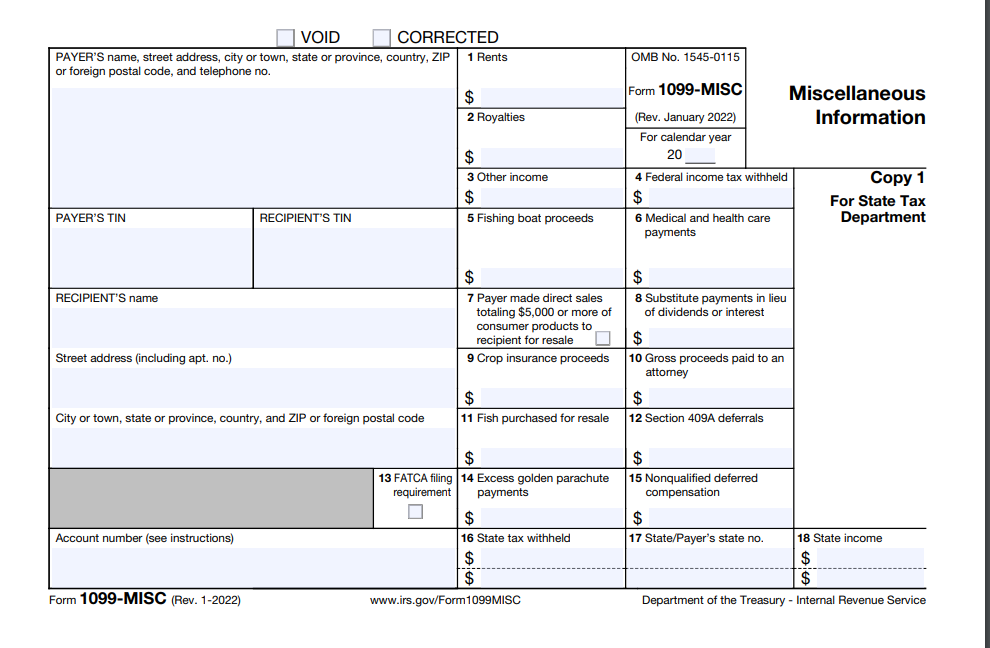

- Copy 1: It is submitted to the recipient’s state tax department.

- Copy 2: This copy is sent to the recipient for their state tax return.

Here is how all these copies look.

Copy A

Copy B

Copy C

Copy 1

Copy 2

Recipient Reporting (Businesses or Individuals)

The recipient must collect all the 1099-MISC form copies (Copy B) received from different payers and attach them to their tax filing as proof of their earnings. If the recipient did not receive any 1099-MISC form copy, they should calculate their earnings from all different sources and mention that during their tax filing. By doing this, they are exercising their due diligence and embodying the qualities of an ideal citizen who pays their taxes in a responsible and lawful manner.

Conclusion

Form 1099-MISC plays a crucial role in the accurate reporting of various income sources, ensuring transparency and compliance with tax regulations. Both payers and recipients are responsible for reporting their financial transactions, and understanding the process helps avoid potential penalties or audits.

For businesses and individuals, providing all relevant information to the IRS and other agencies is essential to fulfill their tax obligations and maintain financial integrity. Form 1099-MISC, along with other tax-related forms such as Form W-2, Form 940, Form 941, etc, serve as a means to achieve this goal.

By accurately reporting income and expenses, businesses and individuals can confidently navigate tax season and demonstrate responsible financial practices. Giving information related to income through the 1099-MISC form helps prevent tax fraud, as the IRS receives all the necessary information concerning income and expenses.

Remember, it is essential to gather all the necessary information and correctly fill out Form 1099-MISC to avoid any discrepancies or issues during tax reporting. By doing so, taxpayers can ensure smooth tax compliance, making the tax season a less daunting experience.